Is property a good investment for retirement?

Whatever your vision for your eventual retirement, there are essential questions you need to ask yourself if you are to make your dream a reality. What do I want to be doing? How much money will I need? How long will my pension savings need to last? How much income will I need each year? Do I want to retire early? And so on. In my experience, the key to achieving your dream is to start saving as early as possible in life and accumulate enough assets to enable you to choose the lifestyle you want in retirement. Should a property portfolio be part of that? Is property investment a good retirement strategy?

The pros and cons of property investments for retirement

This article reviews the pros and cons of property vs traditional investments for retirement and leaves readers to make their own conclusions. Firstly, we will talk about inflation which has been in the news as a source of worry for investors. The US government has promised to spend at least $6 trillion in Covid-19 relief, flooding an economy with extra cash, which is a classic recipe for rising prices. In the UK, in the year 2020/21, relief measures have cost more than £300 billion, which could still lead to much higher costs in the future (and more inflation). One certainty is that when you spend the money you invest in your UK pension or 401(k), or any other state pension, it will not buy as much as when you retire, as it does today.

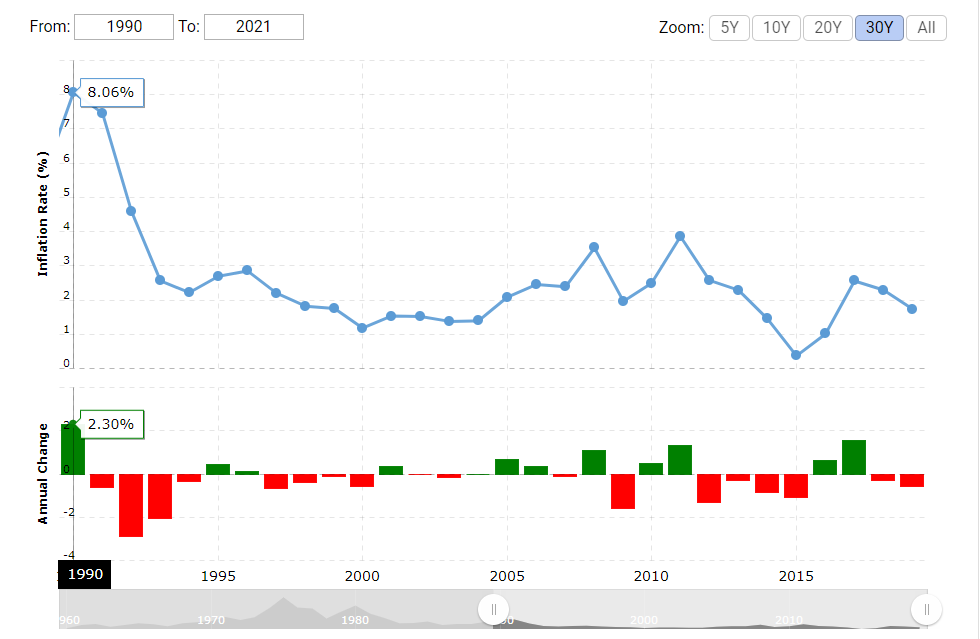

Inflation is a major factor to remember when planning your retirement

Inflation, the steady rise of prices for goods and services over a period, has many effects, both good and bad. One negative factor is that individual purchasing power is reduced over time due to a rise in prices across the economy. Inflation doesn’t pause, which is why owning physical assets like property can be one of the best ways of maintaining your standard of living in retirement. For example, since 1990 the cost of a litre of petrol has increased from 40p to £1.27, a pint of beer from 1.81 to 3.94. According to the Bank of England for a typical UK household, the average cost for a basket of items from a pint of milk to a football ticket has roughly doubled in the last 30 years.

UK Inflation 1990-2021 – a source of data World Bank

See for yourself how everyday items have increased in cost just over the last 10 years at https://www.bankofengland.co.uk/knowledgebank/how-have-prices-changed-over-time.

The pros of real estate investment for retirement

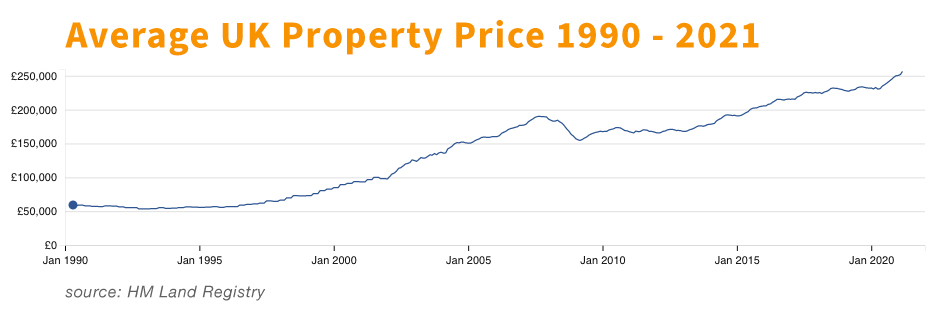

Property is a hedge against inflation

For those trying to get on the property ladder, it is no secret that property prices rise even faster than the rate of inflation. See the table below, which shows the trend for the past 30 years, which is forever upwards. The average dwelling cost in the UK increased from over £50,000 to 303,000 (Source HM Land) during that time.

Real estate offers long-term returns

In addition to the capital growth of your property, the income produced can increase as well. In ten years, the £1,000 monthly rental you receive now will be more like $1,350, with inflation indexing at 3%. You do not have to sell rental properties to generate income. As a buy-to-let landlord, your equity can grow from both directions at once, with steady increases in value and at the same time, your rents can help you pay down the mortgage, so the mortgage debt shrinks as the property value rises.

Tax benefits

Most investors look to tax-sheltered retirement accounts for tax benefits. And while they work well, they also come with plenty of restrictions, such as a minimum age for taking withdrawals, and a cap on how much you can invest each year and so on.

Property retirement income comes with no such restrictions but with plenty of tax advantages. You can deduct nearly all expenses associated with your rental properties: insurance, property taxes, property management fees. In some circumstances, you even deduct mortgage interest to reduce any tax liability and improve the return on your investment.

There are also pension structures for portfolio owners that can be used, which can reduce taxes such as capital gains, income, and inheritance tax. This can be very powerful and increase returns whilst holding the assets in a highly efficient structure. In addition, there are ways to reduce the amount of SDLT (stamp duty) payable on UK properties. If you would like more information on this, please visit Soteria Trusts

Owning a property puts you in control

When you buy a stock, you have no control over its returns. Unless you are a major shareholder, you cannot influence the company’s management decisions. You can do your research, but all you can do is time the purchase or sale of the stock.

You do have control over your returns when you invest in rental properties. You can renovate the property to increase equity and boost the potential rent. If you want direct involvement, you can screen all rental applications to find the most reliable renters. Through proactive buy-to-let property management, you can quickly learn the key property issues and reduce ownership risks.

Property can be easier to understand

Trading stocks can be difficult to understand everything you need to know to be able to make a profit. Many types of investments are complex and require specialist knowledge. Property investment, however, involves the purchase of physical property, and most people are familiar with property purchase through the purchase of their own home. Investing in property can be much easier to understand than complex investments developed by market experts.

Property can be leveraged

Borrowing through a mortgage to buy can be an effective strategy for building a property portfolio if done with care. Real estate investments purchased with hard money or a mortgage can be structured to make large purchases with a relatively small initial investment. The result is the purchase of a hard asset that appreciates year after year, paying for it primarily with other people’s money. It is the basis of the buy-to-let strategy but does come with risk, and too much leverage can be dangerous.

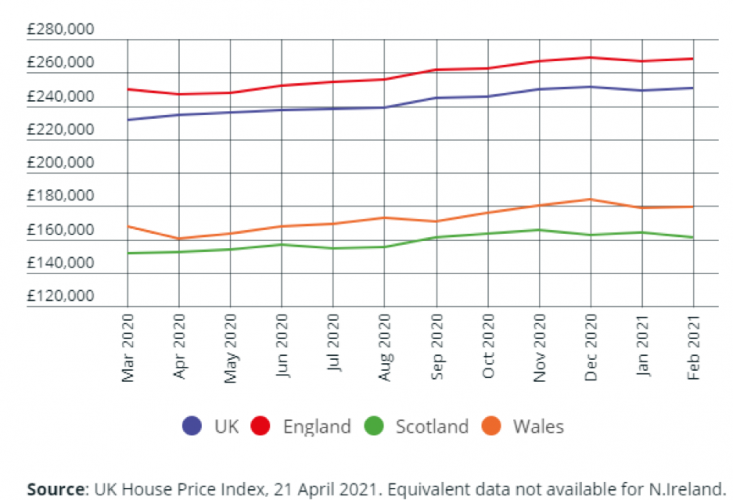

Investment portfolio diversification is a safer retirement bet

Putting all your eggs in one basket is never a good idea. Property investment provides an alternative to the stock market that allows you to diversify your portfolio truly. The value of a property may fluctuate up and down, but the property itself is a hard asset, and will always be there. People talk about diversifying their portfolios by moving some of their investments from one sector to another, say from banking to consumer discretionary stocks, but they are still subject to market volatility which we have seen so much of during the Covid-19 pandemic, while property prices have been relatively stable. The Land Registry says the average cost of a property in the UK actually rose by 8.6% year-on-year in February 2021 to reach £250,341, as shown in the graph below.

The cons of property as a retirement investment

Property purchase has higher transaction costs

Unlike other types of investments, transaction costs can significantly affect the value of your investment and make it more challenging to achieve a profit. When purchasing shares of a stock, the transaction cost for the trade is small, often less than 1%. But when buying property, the transaction costs are much higher because they are usually bought with a mortgage and the associated fees.

Property has low liquidity

Selling a property may take time, and you may need to renovate first, which costs money. Owning a property means that a large portion of your wealth is tied up in a relatively illiquid asset and not easily accessible when you need it. With stock trading, many investments are highly liquid and can be bought and sold instantaneously. Still, property investments are comparably illiquid because they cannot be quickly sold without a substantial loss in value. Property investors must be prepared to own a property for years rather than months, especially when it is rented.

The property requires management and maintenance

Owning and operating rental properties requires time and effort. When you buy a property, you need to shop around to get the best deal. It takes time to find good tenants and oversee maintenance and repairs.

Unpredictable repairs can happen and can be costly. Besides, property taxes typically increase annually, as does the cost of homeowner’s insurance. These all add to your annual expenses. You can, of course, use the services of a property management company to oversee tenant acquisition and maintenance, but the standard cost of this is around 10% of the monthly rent.

Property creates liabilities

The price of the property may be very high, depending on the country and area you select. You will have property taxes to pay, times where a rental property will be vacant while you still have mortgage payments to make and the cost of repairs and maintenance that all need to be done.

As an example, during the Covid-19 pandemic, as the economy suddenly slowed, tenants moved out, and property investors did not have the cash flow to keep paying the mortgages on their vacant properties while waiting for the lockdowns to end. Consequently, some were forced to sell at below-market price because they did not have cash reserves for such an event and others faced bankruptcy. Many people have lost all of their properties because they used too much leverage.

Is property a good investment for retirement?

For diversification reasons alone, the buy-to-let property can be a good investment for your retirement if you prepare yourself and go about it the right way. One of the biggest fears among retirees is outliving their retirement savings. With the traditional “money-fund pension” approach to retirement, there is always a possibility that this could happen. Every time you make withdrawals from your retirement account to live, the balance reduces. However, an income-producing property portfolio as a part of your retirement strategy can give true diversification and long-term appreciation for a secure future.

Over time, if you work systematically and patiently to grow your property portfolio, you can build a steady source of retirement income. Many financially independent people have built their wealth with income-producing properties. This requires a long-term view and the ability to keep records and deal with tax considerations.

Is property investment to fund your retirement for you?

Investing in property for retirement can provide significant benefits. Most importantly, the property is a solid “bricks and mortar” asset for you, and in the future, an asset for your children. However, before making any decision, it is important to assess your skills and available capital to determine how to choose your first investments and boost your property knowledge at every opportunity. The decision to buy is one you should think through carefully.

Carefully consider the pros and cons of property as a retirement investment before making any big decisions. When selling, always plan for the situation that any property might not sell as quickly as you thought it would so that you have enough cash to cover the mortgage until the sale. Otherwise, you may have to sell at a lower price or wait for the housing market to improve.

Investing in property is not for everyone. It can diversify your assets, or it can consume them and have the exact opposite effect. Owning a buy-to-let property provides a steady stream of retirement income but is not a passive occupation; it requires time and effort to achieve success. If you would like to learn more and get an impartial consultation with one of Lifestyle Property International’s experts, please contact us.