What are property cycles, and where are we now?

As our population grows, demand for properties increases, too – both for rental and homeowners. When people start to buy and rent properties, the value of properties rises, which is due to the simple forces of supply and demand. What causes demand for real estate purchases to increase? What are the property cycles, and where does the property market stand now? Will the COVID-19 pandemic shake the UK real estate market enough to prompt a change in the typical property cycle, or maybe it is just a correction and a quick rebound?

What are property cycles?

In theory, property markets all over the world follow a predictable pattern of three property cycles: the Boom, the Slump, and the Recovery phase. It is impossible to give a clear answer to the question of how long the property cycle lasts, however, the average length is about 8-10 years.

Property cycles are closely associated with changes in macroeconomic indicators such as GDP, inflation, unemployment, or worldwide events, such as the current pandemic. Property cycles affect supply and demand for property, subsequently influencing the property market. Due to many reasons, such as the need for more space to work from home, the government’s Stamp Duty Land Tax holiday, and record low-interest rates, the UK real estate market is now in the booming phase, although showing no sign of slowing down anytime soon.

The Property Cycle Boom

The Boom phase is the peak of the property cycle. It occurs when property prices and rents are driven up by high demand. Investors can more easily borrow money, and the lenders are keen to do so as the overall market outlook is positive. In the Boom phase, investors are confident about the market, and that the time to make such an investment is now.

Related: UK Expat Mortgage for Buy-to-let explained

The Property Cycle Slump

The Slump phase is characterised by the property market slowing down. The demand for investment is drying up, and such is the access to credit. Both homeowners and investors reduce demand for property by not purchasing it, causing property prices to stall or even fall. Sometimes, the Slump phase can happen slowly as investors begin to doubt the sustainability of the Boom phase, and people are more cautious with their money. An example of this would be the 2008 global financial crisis.

The Property Cycle Recovery

Typically the shortest of the three stages, the Recovery phase marks a return to growth for the property market. During this phase, many investors will question whether the increases in rents and prices are sustainable. Once confidence returns, this phase naturally transitions back into the Boom, and the whole process begins again.

Why should you care about the property cycles?

Property cycles are rather abstract ideas, and as such, they act as an indication of what is happening right now in your local market so that you can make a smart decision.

Usually, buying real estate in the Boom Phase will cost you the most money, but borrowing is easier. Buying a property in the Slump Phase can cost you less, but access to a mortgage can be harder, and since this phase is usually associated with a general market crisis, you might yourself question whether you can and should afford such an investment.

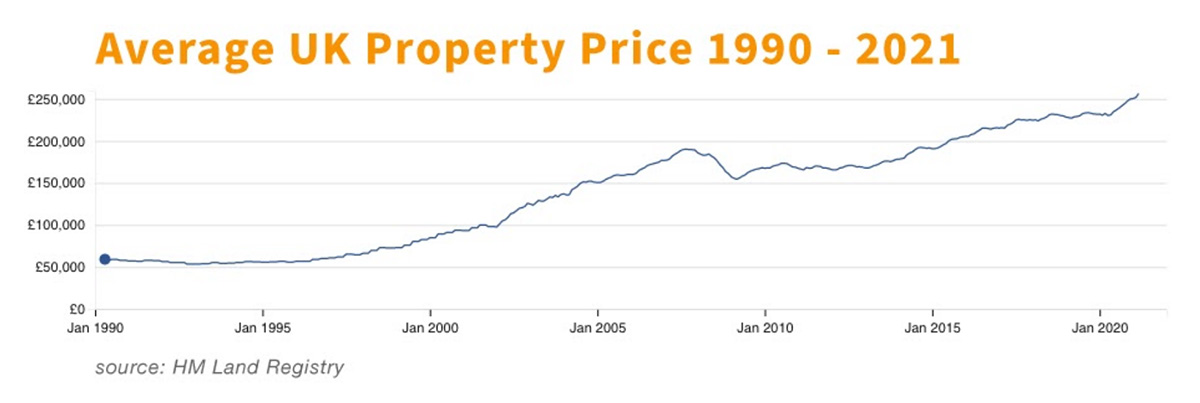

However, even if you buy a property during the peak of the property cycle, if you hold on to the investment, it would turn profitable as the general trend for property prices is upwards.

What is the current property cycle?

2020 and early 2021 shows all the signs of the Boom phase, especially in the United Kingdom. The introduction to the 95% mortgage and historically low-interest rates make borrowing more accessible and compelling. This, plus another government incentive – the Stamp Duty Land Tax Holiday, and a change in homeowner preferences due to the coronavirus pandemic pushed the demand up, which in turn saw house prices in some areas increase by up to 10% over the past 12-months.

To buy or not to buy?

The Boom cycle gives you more property options and easier access to mortgages, while slump and recovery phases might give you lower property prices or bigger discounts, but getting a favourable mortgage might be harder, and the choice of properties smaller, too. It might be harder to rent the property in these stages, too.

The decision to enter the property investment market is a very personal one. The worst thing you can do is to make investment decisions based on emotions. Engaging with a property consultant can give you the advantage and peace of mind that they will conduct a full review of your situation before making any recommendations to ensure you make a good investment in line with your objectives.

Remember, while property cycles can give you an overall overview of the current market situation, property investments tend to increase in value over time – assuming you hold onto them for long enough. With the right guidance on the property financing and by choosing the right investment property (high expected rental yields, and in a location which is predicted to see property prices to rise the most), it shouldn’t matter as much in which property cycle you decide to buy an investment property.